Multifamily Blogs

Ownership Goals - A Guide for Property Employees and Regionals

Ownership Goals - A Guide for Property Employees and Regionals

The best way to gain recognition for a job well done is to find your investor's goals, take ownership, and make them your goals. But how can property-level staff and regional managers do a great job without knowing the ownership goals? This article attempts to solve that problem by providing an overview of common ownership structures and the goals of each.

After reading the article, you will know: 1) what is a real estate organizational chart, 2) what are the goals of each investor type, and 3) how you can accomplish their goals. Armed with this information, you will be well-positioned to drive performance and make a credible case for promotion, pay increases, or alternative benefits and recognition.

The Two Basic Investor Types

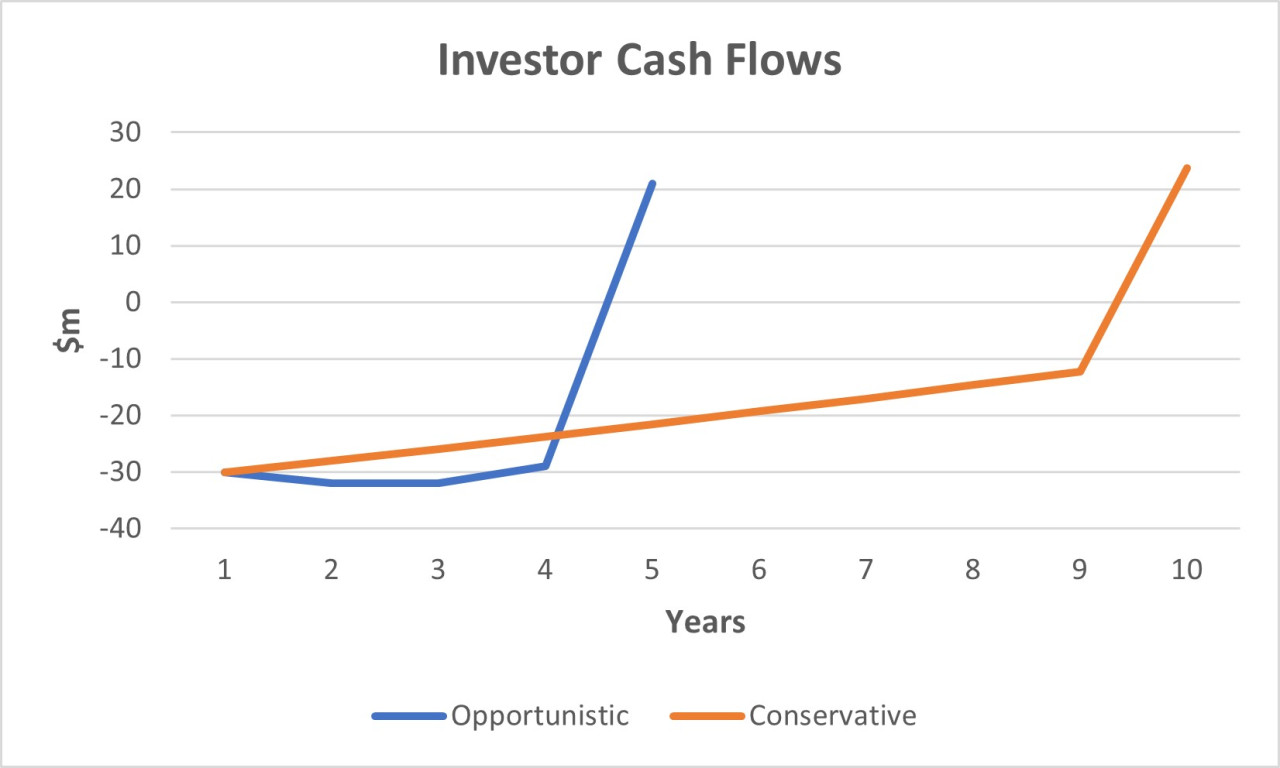

The cash flow visual above summarizes the differences in investor expectations between the two major investor categories – conservative and opportunistic.

The opportunistic investor is impatient and time-sensitive since delays are costly. However, they can tolerate negative cash flow (for a while) so long as the property value increases (e.g., investing in amenities). As you can see from the chart above, the timing is much quicker compared to the conservative investor.

The conservative investor has more of a time cushion. A good year can compensate for a bad year. If the market doesn't make sense for a sale, they can hold an extra year or two (or several!). So long as the cash flows are consistent, these folks are happy.

The different risk profiles reflect the two biggest priorities of each investor:

- The Opportunistic Investor – wants to make a lot of money quickly.

- The Conservative investor – mostly wants to avoid losing money.

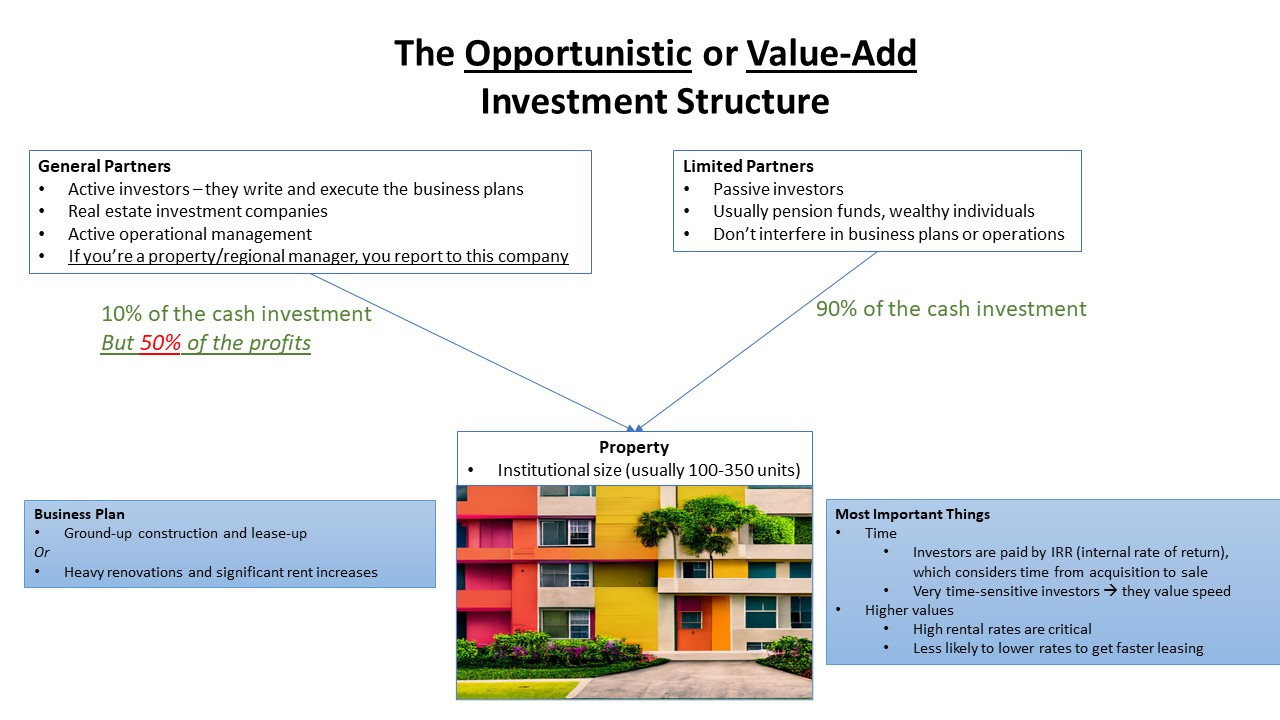

- The Opportunistic or Value-Add Investor

The opportunistic investor focuses on value creation. They buy (or build), improve, and sell properties as fast as possible.

Generally, roles at properties owned by opportunistic investors can be the highest paid of the major categories because the ownership group has promised investors compelling financial returns and is under pressure to meet these goals. Working for an opportunistic investor can be rewarding financially and may lead to faster career progression, though it will most likely be a high-stress role.

Though the opportunistic and value add investors include ground-up construction and heavy renovation of existing properties, their motivations are similar. Both are time-sensitive. They have a limited window to achieve their goals, and every delay means less profit for the investors.

Consider the example below. A property is acquired for $50m and sold for $55m, generating a profit of $5m. Great! But the investor's opinion of the deal will vary depending on the time invested. At two years, the sale generated a 13.4% internal rate of return (IRR – a measurement considering both the cash and the time invested). But at four years, the deal only generated 6.5% IRR. Half the return! Suppose you're the investment manager and only make money if the deal generates 8% IRR or higher (a typical structure). You need to increase the value and sell it ASAP; otherwise, your deal will get worse by the month.

Tips for working with opportunistic real estate investors.

- Understand their business plan and timing. Demonstrate an interest, and they will be happy to share details since they will see your potential contribution.

- Be proactive about generating goals and milestones. Maybe they want to renovate the property in two years (e.g., 200 units). Talk about interim milestones, potential challenges (come with solutions to these!), and how to find the right team to meet these goals. For example, maybe you have experience with vendors who are always on time but a little more expensive. This is excellent information for the owner if the investor is time-sensitive.

- Understand how to add value to the property. For example, assuming a 5% capitalization rate (current average market rates), every $1 of extra Net Operating Income (NOI) is worth $20 in value increases. So, if you can increase Other Income (e.g., pet fees) by $20,000 per year (e.g., by adding 40 dogs at $40/month pet rent), you just added $400,000 in value to the property!

- Consider technology improvements. PropTech solutions can work well for multifamily, though try to focus on those solutions that are more direct à increasing revenue, decreasing vacancy/economic loss, or reducing expenses. If you're pitching a PropTech solution, reference the NOI increases in the pitch to increase your chance of success.

- Be ambitious. The owners are already ambitious and under pressure. You will align better with their goals if your ideas and plans for the property are ambitious too. For example, consider value enhancement initiatives beyond the owner's existing projects when compiling the budget for the following year.

- Be creative. More often than not, the owner's business plan is to build or renovate and then charge higher rents based on the unit and amenity finishes compared to the competitors. And this is because it usually is the strong lever that can be pulled to increase rents. However, you can be creative with value enhancements. For example, instead of considering the "average" renter, consider the requirements of niche renters, such as dog owners, remote workers, fitness enthusiasts, etc. It's unlikely that all of these renters are satisfied by the competitors. Instead, see which may be an untapped source of renters and create a mini business plan to appeal to these customers. Value add and opportunistic owners are willing to spend money so long as they see a viable business case.

- Be organized, especially with reporting. Asset managers hate reporting but need the information. Reporting to their investors is a necessary chore, but reporting to them is mission-critical intelligence. Know which is which so you can allocate your time appropriately.

- Create incentives. Aligning property-level incentives with ownership incentives is a great way to show commitment to the investor's business plan. For example, leasing renovated units at premium rents may have a higher leasing commission than leasing non-renovated units or at lower rents. Owners will be open to this change.

- Be a sponge in the market. It would help if you were the local expert. Spending a few hours every week or two touring competitors and talking to other market participants (e.g., leasing staff, vendors at your competitors, etc.) can provide great intelligence for your asset ownership

- The Conservative ("Buy and Hold") Investor

The conservative investor buys real estate to achieve consistent, reliable cash flow and to avoid risk. Because of this, ground-up construction and heavy value-add rehabilitation deals are avoided.

Conservative investors don't have powerful incentives to increase valuations quickly. This is because their profits are primarily based on cash distributions over more extended hold periods instead of "quick flips."

If you help a conservative investor achieve their goals, you can expect to be rewarded with a stable position in a quality apartment community over potentially several years. Your base salary may be higher than in a smaller or value-add-type community, but your bonuses and progression may be lower since you have less of a "test" from which to prove yourself against.

How to work with conservative investors?

- Set expectations early so you understand their goals. For example, are they thinking about a five-year hold or more of a ten-year hold?

- How much innovation or creativity do they recognize? Conservative investors, like all investors, vary dramatically in their interest or openness to technology or new solutions that may increase NOI. While conservative investors don't have the timing pressure, they may have interests in technology or innovation that may create opportunities.

- Do the basics very well. Deliver reports on time. Be proactive about communicating challenges. Ensure the team is professional and motivated. Assume that a team member from ownership is secret shopping every day!

- Prioritize reputational management – for both the property and the ownership group. For example, initiatives and results that lead to local or regional media coverage will be valued and promoted.

While the two investor profiles vary dramatically in their goals and approach to achieving them, property-level employees and regional property managers can achieve their personal and professional goals with either of these ownership groups. Therefore, knowing your strengths and the goals of the ownership group can put you in the best possible position to be successful.