Multifamily Blogs

Why Single-Family Markets Matter to Multifamily

Why Single-Family Markets Matter to Multifamily

The multifamily and single-family rental industries have their share of differences, from disparity in scale to NOI growth and market presence. But some considerable overlap exists between the two asset classes in terms of investment opportunities.

An increasing number of multifamily owners and operators are looking to expand in build-to-rent single-family housing because the single-family asset class is on track to outperform other real estate sectors over the next decade. Suburban Sun Belt markets, specifically, present the most overlap -- and competition -- between multifamily and single family. While operations and expenses vary between the two asset classes, drivers of demand and rent growth are very similar:

Similar rent growth drivers

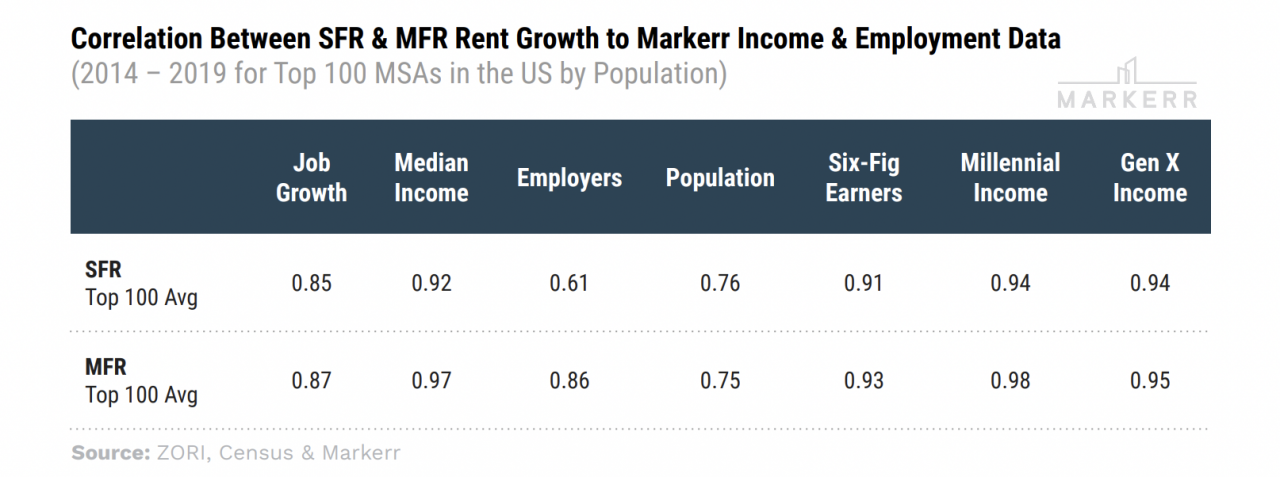

Data from Markerr found the key rent growth indicators for both asset classes are job, income and population growth. Considering multifamily and single family share the same rent drivers and demand indicators, leveraging alternative, granular data with real-time updates is immensely valuable to both asset classes as the investment space gets more competitive.

Looking at unique, granular data can identify attractive opportunities at the market and submarket levels that may not be apparent to investors, owners and operators relying on traditional data.

Overlap in resident profiles

Suburban Sun Belt markets have been outperforming all other markets in terms of revenue growth, and single-family rentals in these markets pose the biggest competition to multifamily communities, according to a single-family investment report from Markerr. A recent report on single-family markets note that exurban and suburban areas have massively outperformed all other geographic densities since the onset of COVID.

While single family isn’t as much of a threat to multifamily in urban core markets, apartment owner/operators looking to expand in suburban markets will target the same geographic positioning and similar resident profiles as single-family rentals. The typical single-family rental resident is a dual-income family with fairly high household income, about 40 years old, a slightly lower FICO score (600s) and a limited savings for a down payment. But the resident base of multifamily is generally more diverse, including suburban families, young people in urban areas and affordable housing tenants.

Because of the resident profile overlap in suburban markets, multifamily and single family will compete for the same residents, especially suburban Sun Belt markets.

Diverging supply trends

It’s also worth noting the scale differential between multifamily and single family. A large part of this is because multifamily has been around for much longer than single family and had significantly more time to expand portfolios. According to a single-family rental report from Markerr, the largest multifamily companies operate between 70,000 to 100,500 units, compared to single family’s largest players that operate between 13,000 to 80,500 units.

Multifamily supply has ramped up since the global financial crisis while single family has experienced a dearth in construction. A driver behind this diverging trend between asset classes is attributed to lower homeownership rates, spikes in material costs and an increase in labor prices.

According to data from Markerr, the median single-family home price increased from $183,089 to $287,161 within six years. This home price appreciation makes renting more likely, as saving for a down payment -- the main difference between single-family renters and homeowners -- is estimated to take 35 to 40 months for a 20% down payment on the median home price.

Demand increased for single-family rentals during COVID while renters flocked to the suburbs and there wasn’t enough single-family supply built over the last decade, leading to large spikes in new lease growth rates. As the millennial demographic transitions from apartments to larger homes and employment in suburban and exurban areas continues to grow, the single-family rental trend will continue to grow.

Rent growth is similar for multifamily and single-family rentals, and multifamily investors can gain a lot of insight from paying attention to single-family trends and nontraditional, granular data. By looking at real-time data based on zip-code specific education, hiring and income, multifamily asset managers and investors can more effectively forecast rental growth and identify markets and submarkets primed for opportunity as the reach for yield continues.