Multifamily Blogs

4 Key Functions of Business Intelligence

4 Key Functions of Business Intelligence

Information is power. And power is finally starting to come to multi-family housing. One of the trends I’ve seen in my practice the past few quarters is increased interest, and investment, in access to data. It largely comes in two forms: purpose-built tools aimed at providing deep insights into specific dimensions (think Rainmaker’s Slopejet, now called Intelligent Lead Management) and more general purpose overall business intelligence (BI) systems (think Rentlytics for an “off the shelf” tool or ReLuminous for more custom-designed solutions).

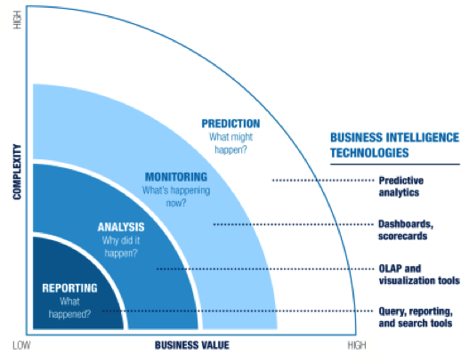

But before anyone starts making BI decisions, it’s a good idea to understand some of the basics. As covered in a white paper I co-wrote with Chris Brust, Business Intelligence is a set of methodologies, processes, architectures, and technologies that transform raw data into meaningful and useful information used to enable more effective strategic, tactical, and operational insights and decision-making. In practice, it consists of four key functions, each more complex and driving more business value than the function below it.

The simplest and most ubiquitous (though interestingly often driven the least real value) isreporting. Reporting tells us all about what has already happened. One of the key things about reporting is that it is very static. A key limitation to reports is that, even if they are very parameter driven, they don’t allow users the ability to dig more deeply, aggregate up, etc. thus liming the insights they deliver. Also, by definition, reports are backward looking also limits their value for forward-thinking decisions. Reporting is important (even necessary) but rarely do reports make it obvious what to do next—what to change, what to keep the same, etc. Reports, queries and search tools give us an excellent sense of current or past state and pretty much end there.

The next function up the complexity and value ladder is Analysis. Because analysis focuses on why things happened, it’s much more valuable for contributing to making good decisions. This is the world of visualization and Online Analytical Processing (OLAP). Graphs and infographics can connect data elements and present them in a way that makes their relationships more obvious; statistical processes can be brought to bear on the data to give us a sense of how reliable those conclusions are; and OLAP tools let us explore these relationships by drilling down to more granularity, up to higher levels of aggregation and across to find relationships that weren’t immediately obvious.

The critical difference between reporting and analysis is that ability to explore the data and relationships in an efficient way as opposed to being limited to a rigid view of the information. OLAP and visualization tools are key to this competency.

Monitoring takes us another level higher in complexity. Because it tells us exactly what is happening now, it can provide immense value by allowing us to identify issues, intervene and correct in near real time rather than waiting for a report to tell us how badly we did and the ensuing post mortem analysis to tell us why the bad results occurred. Dashboards, scorecards and alerts allow us to make decisions to create good results proactively and avoid bad performance before it accumulates.

There’s actually a term for this particular form of monitoring. “Operational business intelligence,” sometimes called “real-time business intelligence,” is an approach to data analysis that enables decisions based on the real-time[1] data companies generate and use on a day-to-day basis. This use leverages BI tools and algorithms to improve the day-to-day activities of front-line workers. Examples include tools to help control expenses, utilities, monitor renewals, etc.

The “holy grail” of BI is predictive analytics (by the way, it’s also where the most snake oil is sold). Predictive analytics process the data to come up with predictions of what might happen in the future. While not yet widespread in multi-family housing, there are some predictive analytics already in the common technology stack. For example, credit scoring applications predict likely bad debt and pricing and revenue management systems predict optimal rents to balance occupancy and yield. Predictive analytics value, when executed well, should be obvious—if we know something about the future, we have even more opportunity to affect that future, or at least to prepare for it as part of our decision making process.

I find most multi-family operators are swimming in a sea of reports. They’re desperate for the analytics and monitoring a strong BI platform provides. Except for a few special needs (like credit scoring and pricing as mentioned above), they don’t really need a lot of predictive analytics. Armed with an understanding of this BI maturity model, you can now assess where you are on that curve and what kind of OLAP, visualization and dashboarding will get you to the next level.

[1] In multi-family BI, we include both “near real time” (i.e. data complete as of the prior night) with true “real time” (i.e. data as of now)

![]()