The movement to seal eviction records is gaining traction, as advocates push to prevent past filings from limiting tenants' housing options indefinitely. During the pandemic, federal protections reduced eviction rates in major metros, but these safeguards have since expired, driving eviction rates above pre-pandemic levels in many cities, especially in the Sunbelt. States like Maryland, Massachusetts, and Idaho have passed laws to seal records...The movement to seal eviction records is gaining traction, as advocates push to prevent past filings from limiting tenants' housing options indefinitely. During the pandemic, federal protections reduced eviction rates in major metros, but these safeguards have since expired, driving eviction rates above pre-pandemic levels in many cities, especially in the Sunbelt. States like Maryland, Massachusetts, and Idaho have passed laws to seal records in cases where tenants won or settled out of court, allowing renters a “clean slate.” Housing advocates argue that eviction filings act as a “Scarlet E,” unfairly stigmatizing tenants—even when cases don’t end in removal—often leading to denied applications and increased housing insecurity.

New research reveals that eviction records disproportionately impact vulnerable populations, especially low-income Black women. As a result, more states are considering sealing laws to address rising evictions and tenant protections. For landlords, eviction records offer valuable insights into a tenant’s payment history and stability, but these records are often incomplete or misleading, leaving room for misinterpretation. In response, screening firms are now adjusting practices to better reflect a tenant’s full rental history while adapting to new state laws.

Washington, D.C., has implemented a balanced approach, allowing sealed records for research purposes. This compromise offers a model as states move toward tighter tenant protections, spurred by a growing housing crisis. The trend toward sealing eviction records is reshaping the rental market, requiring landlords to adopt new screening strategies.

propmodo.com/why-eviction-records-may-soon-be-seal…

Show more

The recent apartment construction boom is slowing as developers grapple with rising costs and tighter financial conditions. This trend reflects broader industry challenges today.Key Takeaways:Rising Costs: Higher interest rates and construction costs have made many projects financially unfeasible, pushing many plans back to the drawing board.Extended Delays: The average time between construction authorization and project start has increased by 45 ...

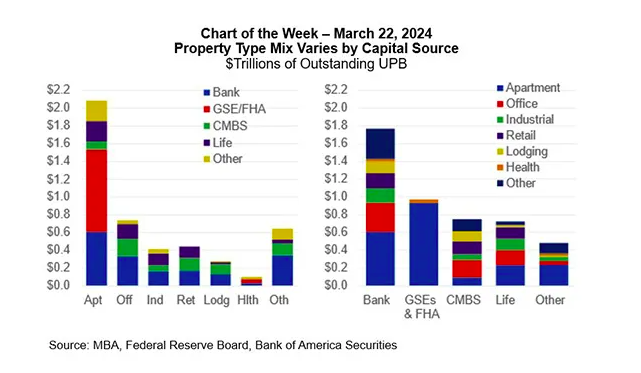

This week's Chart of the Week shows MBA's estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources. As can be seen, CRE mortgage debt is not a monolithic market. Rather, it is made up of a broad range of intersections – across property types and capital sources (shown above), as well as property subtypes, metro markets and submarkets, owner types, vint ...

A good read on how institutional SFR owners are adapting their acquisition strategy.

In the current real estate landscape, driven by soaring interest rates and record-high home prices, Wall Street investors are adapting their strategies to maintain profitability. The traditional approach of acquiring individual homes scattered across the country is becoming inefficient and less lucrative. As a result, a new trend is emerging - the development...A good read on how institutional SFR owners are adapting their acquisition strategy.

In the current real estate landscape, driven by soaring interest rates and record-high home prices, Wall Street investors are adapting their strategies to maintain profitability. The traditional approach of acquiring individual homes scattered across the country is becoming inefficient and less lucrative. As a result, a new trend is emerging - the development of build-to-rent communities designed for families.

Key Points:

Market Trends and Challenges:

Interest rates are at multiyear highs, making traditional home purchases less attractive.

Home prices reached a fresh record high in October, creating challenges for investors seeking suitable returns.

Shift in Investor Behavior:

During Q3 2023, large landlords owning 100 to over 1,000 housing units acquired only 1% of U.S. homes, down from approximately 3% in 2022.

Institutional investors, traditionally dominant in the apartment market, are now eyeing single-family homes for their stronger rent growth and longer tenant stays.

Challenges in Bulk Purchases:

It is becoming harder for investors to acquire newly built houses in bulk, as the limited housing inventory prompts builders to sell directly to regular buyers instead of offering discounts to institutional investors.

Rise of Build-to-Rent Communities:

Wall Street is increasingly turning to the construction of new neighborhoods where every home is designed for rental purposes.

The "build-to-rent" model is gaining traction, with an estimated 10% of new housing construction dedicated to these communities.

Efficiency and Cost Savings:

Centralizing rental homes in one community reduces operational costs, such as maintenance and repairs.

Investors benefit from designing entire neighborhoods, ensuring durable construction with features like hard-wearing countertops and wide hallways.

Growing Concept and Industry Players:

The National Association of Home Builders reports 900 build-to-rent communities nationwide, each averaging 135 to 150 homes.

Real estate investment trusts like American Homes 4 Rent are actively constructing over 2,000 new family homes, while others are forming partnerships with housebuilders.

Potential Impact on Housing Shortage:

The build-to-rent trend may alleviate pressure on the scarce housing market, where the shortage is estimated to range from 2 to 4 million homes.

However, concerns arise regarding the potential lack of charm in these new, rationalized neighborhoods.

In summary, the real estate landscape is evolving as Wall Street investors adapt to challenges by embracing the construction of purpose-built, rental-focused neighborhoods. This shift not only addresses the current market dynamics but also offers potential solutions to the persistent housing shortage in the United States.

Show more

Welcome to the Neighborhood! Wall Street Designed It - WSJ

Big residential property investors are finding it harder to buy in good neighborhoods, so they are building new ones

The single-family rental market is experiencing significant growth, with companies like Tricon Residential, Invitation Homes, and AMH posting rent increases of over 6% in the third quarter compared to the previous year. This surge is attributed to high home prices, making it challenging for potential buyers to afford homes. Single-family rental tenants tend to stay longer, possibly due to a sense of settlement in neighborhoods and school systems. ...

-

Event starts in:

-